-

The Most Underrated Skill in Investing: Patience

When most people hear the words “investing” and “skill” in the same sentence, their minds often jump to complex mathematical formulas or hundred-page spreadsheets filled with charts, projections, and ratios.…

-

(Members Only) 📊 Lesson 9: Basic Technical Analysis for Long-Term Investors

By now, you know how to find great businesses, build a resilient portfolio, and master the emotional side of investing. But there’s one more tool worth learning — basic technical…

-

📉 Israel Strikes Iran: What Happened, What It Means for Markets, and Why I’m Buying the Dip

🗓️ What Just Happened? On June 13, 2025, Israel launched a surprise military operation against Iran, striking nuclear facilities and killing top Iranian officials. The move, known as Operation Rising…

-

(Members Only) 🚀 The New Battlefield: How Defense Is Shifting to Drones — And Where to Invest

The future of defense is unmanned. For decades, global defense spending has been dominated by jets, tanks, and ships. But now, a silent revolution is underway — the rise of…

-

(Members Only) 🧠 Lesson 8: Mastering Investing Psychology — Winning the Inner Game

You’ve learned how to find great businesses, assess their value, and build a diversified portfolio. Now it’s time to face your toughest opponent. It’s not inflation.It’s not interest rates.It’s not…

-

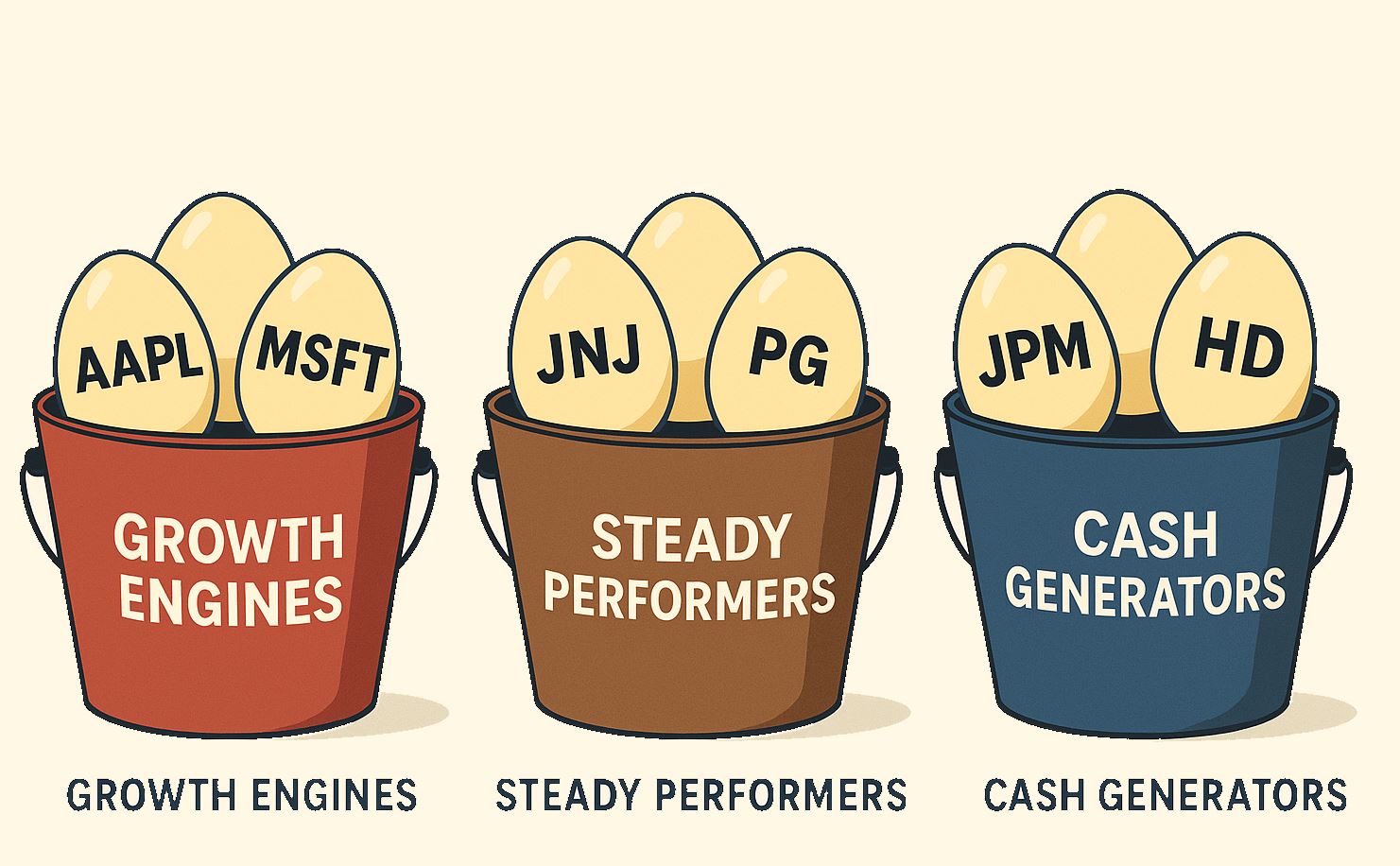

(Members Only) 🧩 Lesson 7: Diversification — Don’t Put All Your Eggs in One Basket

So far in our investing journey, we’ve learned how to identify great businesses, understand their strengths, and ensure we’re purchasing them at the right price. But even the best companies…

-

💸 Best Safe Places to Park Money Right Now

If you’ve been following the investing world, you might have noticed more and more people talking about BIL and SGOV. These aren’t hot tech stocks or high-risk plays — they’re…

-

(Members Only) ✅ Lesson 6: Margin of Safety — How to Protect Yourself When Investing

You’ve mastered understanding the business (Mastery)…You’ve checked its competitive advantages (Moat)…You’ve verified the numbers (Metrics)… Now comes the fourth M: Margin of Safety — the key to protecting your investment…

-

📰 Buffett’s Final Bow: Key Highlights from the 2025 Berkshire Hathaway Annual Meeting

May 3, 2025, marked a historic turning point in the investing world. At the annual Berkshire Hathaway shareholder meeting in Omaha, Warren Buffett—widely known as the Oracle of Omaha—announced that…

-

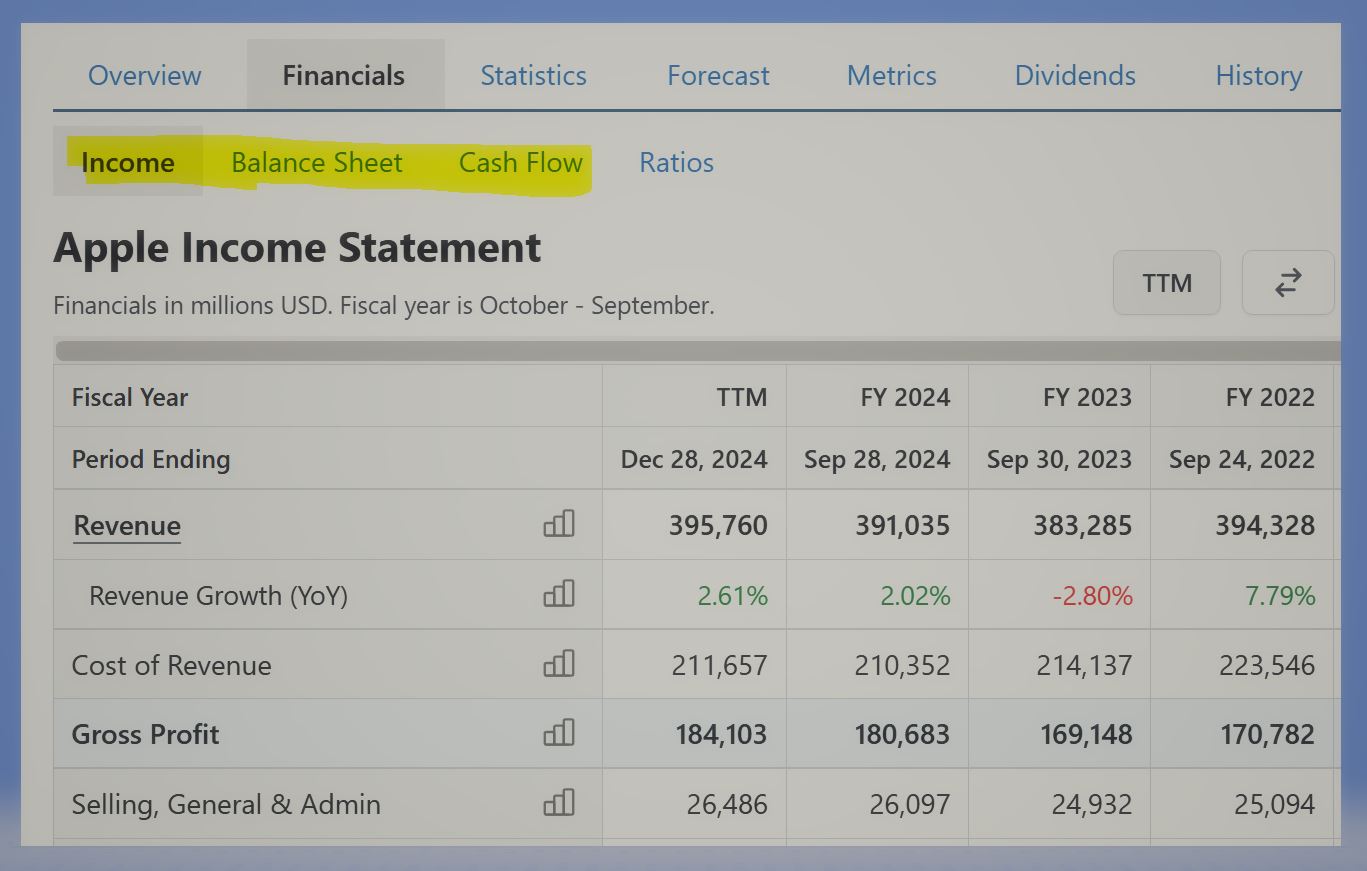

(Members Only) 📈 Lesson 5: Metrics — How to Tell if a Business Is Truly Great

In the last lesson, we talked about Moats — the defenses that protect a business from competition.Now it’s time to dig deeper and figure out if the business itself is…

Recent Post