-

(Members Only) 📊 Lesson 9: Basic Technical Analysis for Long-Term Investors

By now, you know how to find great businesses, build a resilient portfolio, and master the emotional side of investing. But there’s one more tool worth learning — basic technical…

-

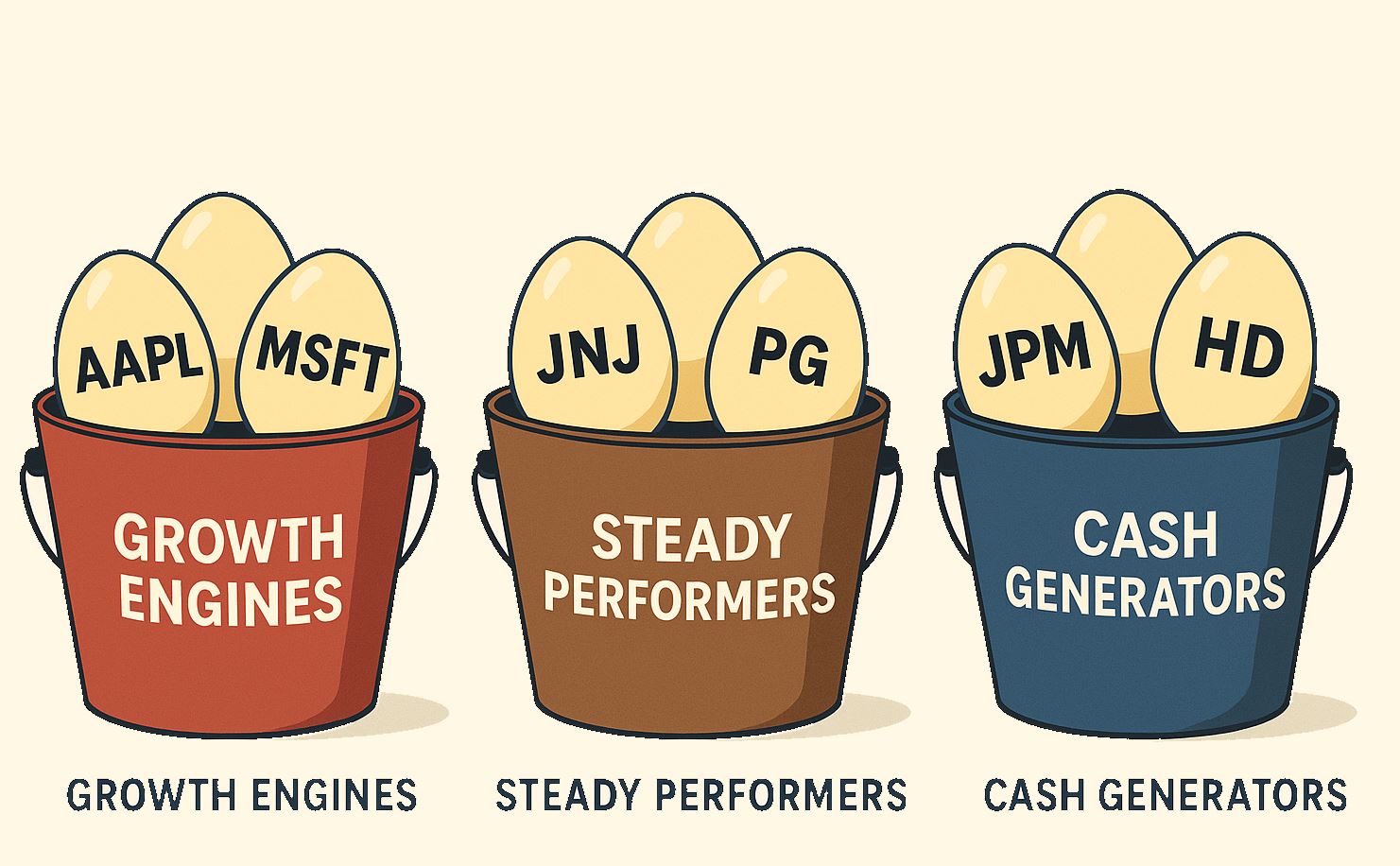

(Members Only) 🧩 Lesson 7: Diversification — Don’t Put All Your Eggs in One Basket

So far in our investing journey, we’ve learned how to identify great businesses, understand their strengths, and ensure we’re purchasing them at the right price. But even the best companies…

-

Why Ignoring the News Makes You a Better Investor

We live in the noisiest market ever. Every minute brings a new headline, a hot take, or an alarming tweet. CNBC flashes “breaking news” banners like fireworks, and social media…

-

(Members Only) ✅ Lesson 6: Margin of Safety — How to Protect Yourself When Investing

You’ve mastered understanding the business (Mastery)…You’ve checked its competitive advantages (Moat)…You’ve verified the numbers (Metrics)… Now comes the fourth M: Margin of Safety — the key to protecting your investment…

-

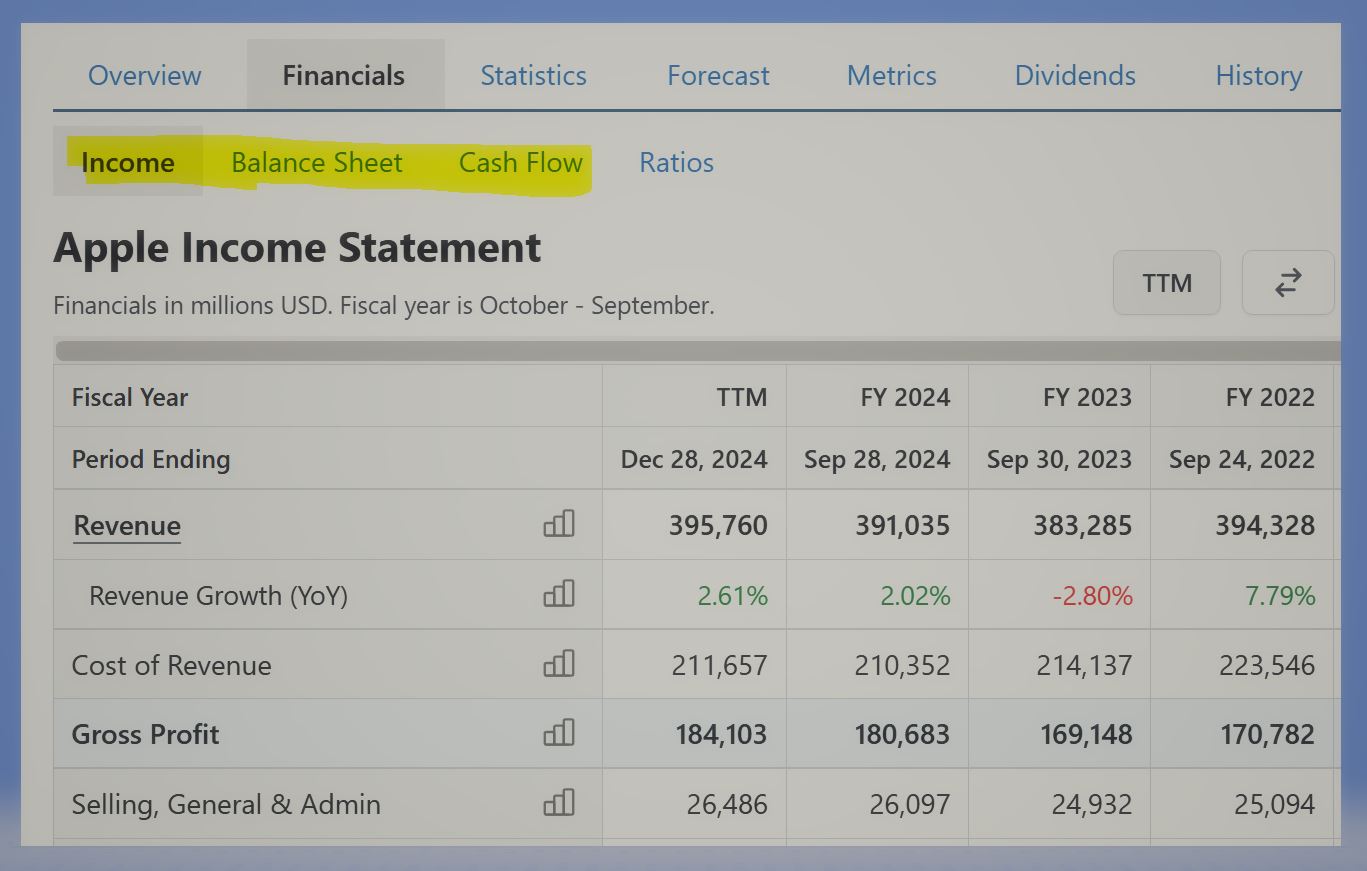

(Members Only) 📈 Lesson 5: Metrics — How to Tell if a Business Is Truly Great

In the last lesson, we talked about Moats — the defenses that protect a business from competition.Now it’s time to dig deeper and figure out if the business itself is…

-

(Members Only) 🛡️ Lesson 4: Moat – What Protects the Business?

In the last lesson, we talked about Mastery — understanding the business you’re investing in. But knowing what a company does isn’t enough. We also need to know what keeps…

-

(Members Only) 📘 Lesson 3: Mastery – Knowing the Business You’re In

Before you invest a single dollar, you need to ask one foundational question: “Do I truly understand this business?” This is the first of the 4 Ms and your starting…

-

(Members Only) 🏛️ Lesson 2: The Two Pillars of Smart Investing — Business Quality and Price

In Lesson 1, we learned that the cornerstone of Warren Buffett’s approach is simple but powerful: don’t lose money. That principle forms the foundation for everything we do as long-term…

-

Mastering Your Emotions: The Key to Long-Term Investing Success

Your biggest enemy in investing is likely yourself—your emotions, biases, and the urge to ‘do something’ when often the best action is no action. Fear and greed are powerful forces,…

-

Investing with Purpose: Building Wealth for the Future – Chapter 9: Bringing It All Together – Your Long-Term Investing Roadmap

As we close this comprehensive guide to long-term investing, it’s time to reflect on the journey we’ve taken—from understanding the psychology of investing and evaluating companies to mastering valuation and…

Recent Post