-

💸 Best Safe Places to Park Money Right Now

If you’ve been following the investing world, you might have noticed more and more people talking about BIL and SGOV. These aren’t hot tech stocks or high-risk plays — they’re…

-

UnitedHealth’s Recent Stock Crash: A Storm of Bad News, but a Buying Opportunity?

UnitedHealth Group (UNH), the largest health insurer in the U.S., has faced a whirlwind of challenges over the past year — from rising medical costs and a major cyberattack to…

-

Why Ignoring the News Makes You a Better Investor

We live in the noisiest market ever. Every minute brings a new headline, a hot take, or an alarming tweet. CNBC flashes “breaking news” banners like fireworks, and social media…

-

(Members Only) ✅ Lesson 6: Margin of Safety — How to Protect Yourself When Investing

You’ve mastered understanding the business (Mastery)…You’ve checked its competitive advantages (Moat)…You’ve verified the numbers (Metrics)… Now comes the fourth M: Margin of Safety — the key to protecting your investment…

-

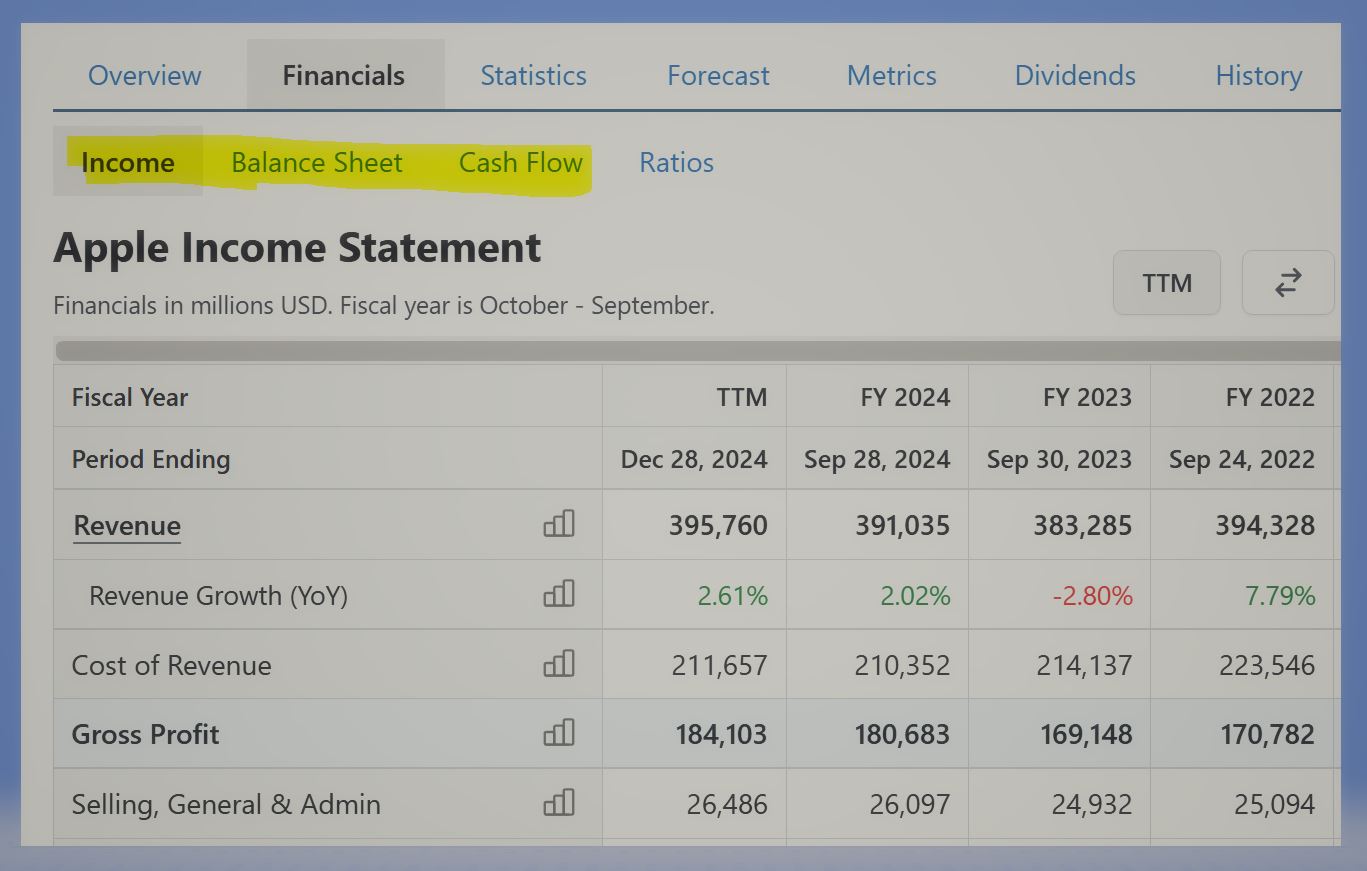

📈 What We Can Learn from Berkshire’s $143B Gain in Apple

At the 2025 Berkshire Hathaway Annual Meeting, Warren Buffett made a statement that left many of us stunned: “Tim Cook has made more money for Berkshire than I ever did.”…

-

📰 Buffett’s Final Bow: Key Highlights from the 2025 Berkshire Hathaway Annual Meeting

May 3, 2025, marked a historic turning point in the investing world. At the annual Berkshire Hathaway shareholder meeting in Omaha, Warren Buffett—widely known as the Oracle of Omaha—announced that…

-

(Members Only) 📈 Lesson 5: Metrics — How to Tell if a Business Is Truly Great

In the last lesson, we talked about Moats — the defenses that protect a business from competition.Now it’s time to dig deeper and figure out if the business itself is…

-

(Members Only) 🛡️ Lesson 4: Moat – What Protects the Business?

In the last lesson, we talked about Mastery — understanding the business you’re investing in. But knowing what a company does isn’t enough. We also need to know what keeps…

-

(Members Only) 📘 Lesson 3: Mastery – Knowing the Business You’re In

Before you invest a single dollar, you need to ask one foundational question: “Do I truly understand this business?” This is the first of the 4 Ms and your starting…

-

Why Cambodia Needs Both China and the US

Why Cambodia Needs Both China and the USWhat Q1 2025 tells us about the country’s economic balancing act Recent data from Cambodia’s first quarter of 2025 paints a clear picture:…

Recent Post