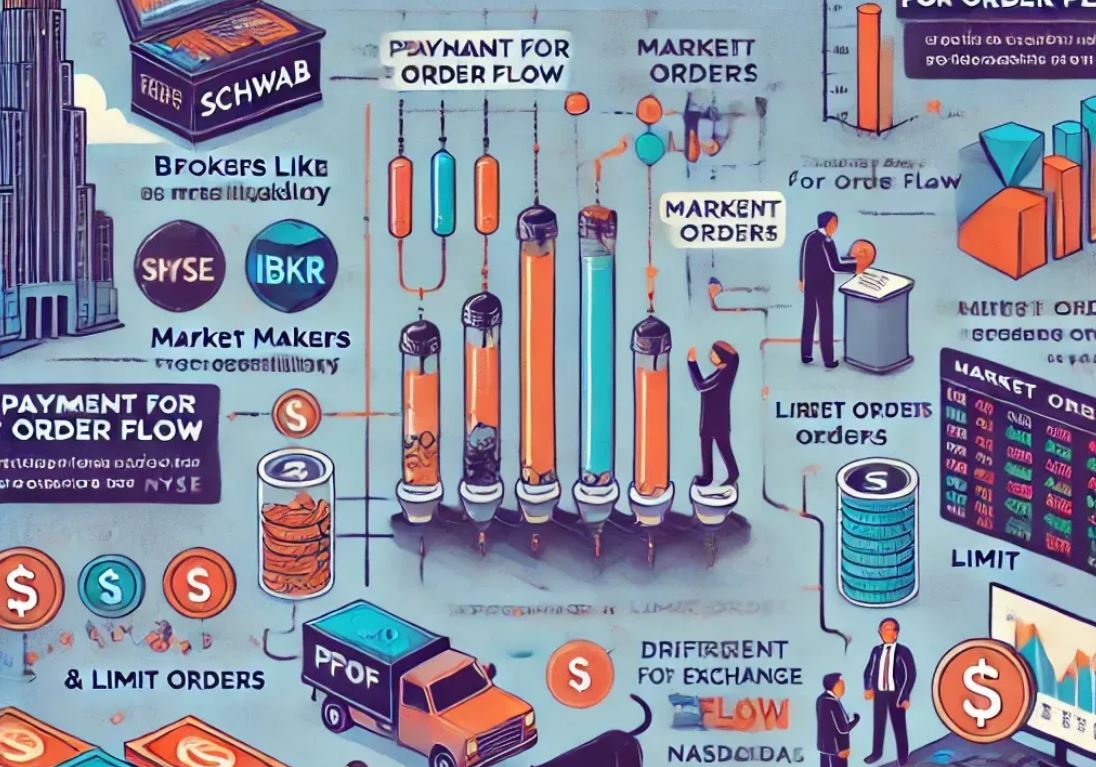

When you invest through popular brokers like Charles Schwab or Interactive Brokers (IBKR), you’ve probably noticed that most trades are now commission-free. This change has made investing more accessible, but if you’re not paying fees to trade, how do brokers make money? The answer lies in Payment for Order Flow (PFOF).

In this guide, we’ll explain how brokers, market makers, and exchanges work together, how PFOF operates, and how your market or limit order plays a role.

The Role of Brokers:

Brokers like Schwab and IBKR are the intermediaries between you and the stock market. When you place an order to buy or sell shares, your broker sends the order for execution to get you the best price.

In the past, brokers charged commissions for each trade. For example, when I started investing decades ago, TDAmeritrade’s commission was $25 per trade. But today, most brokers have eliminated commissions, and they now earn revenue from PFOF instead of charging you directly.

What is a Market Maker?

Market makers are financial firms that provide liquidity by constantly being ready to buy or sell stocks. They quote both buy (bid) and sell (ask) prices, and their profit comes from the small difference between these prices—called the bid-ask spread.

Market makers use the spread to their advantage. If you place a market order (to buy or sell immediately), the market maker may buy the stock from someone else at a lower price and sell it to you at a higher price, pocketing the difference. Similarly, for limit orders, they may buy the stock below your target price and sell it to you at the price you’ve set.

How Payment for Order Flow (PFOF) Works?

When you place an order with your broker, it doesn’t always go directly to a stock exchange like the NYSE or Nasdaq. Instead, the broker often routes the order to a market maker first. In exchange for this order flow, the market maker pays the broker a small fee—this is PFOF.

For example, if you buy 100 shares of stock, your broker might route the order to a market maker, who pays them a small amount (fractions of a penny per share). Once the market maker executes the trade, it’s sent to the exchange to finalize the transaction.

The Role of Exchange Fees:

While brokers and market makers earn through PFOF and spreads, stock exchanges (like NYSE and Nasdaq) charge exchange fees for executing the trades. Although you’re not paying a commission to the broker, investors still pay fractions of a penny in exchange fees, which the broker collects and passes on to the exchange.

How Your Orders Work (Market vs. Limit Orders)?

Market Orders A market order tells the broker to buy or sell immediately at the current price. When you place a market order, the broker sends it to a market maker, who fills the order at the best available price. The market maker may buy the stock at a lower price and sell it to you at a slightly higher price, keeping the difference (the spread) as profit. They then pay your broker a PFOF fee for routing the order to them.

Limit Orders A limit order allows you to specify the price you’re willing to pay for a stock (if buying) or the minimum you’ll accept (if selling). For instance, if you place a limit order to buy at $50, the market maker might buy the stock at $49.90 and sell it to you at $50, profiting from the $0.10 spread. Even with limit orders, the market maker pays your broker a PFOF fee for handling the order.

How Brokers Make Money Without Commissions?

PFOF allows brokers to make money from market makers, while investors still cover exchange fees (fractions of a penny per trade) when the order is executed at the exchange. Market makers profit from the spread by buying low and selling at the price you’ve set, and they share a small part of that profit with your broker. This system lets brokers offer you commission-free trading, while market makers and exchanges still earn their share.

Conclusion

Even though brokers like Schwab and IBKR don’t charge commissions, they still make money through PFOF. By routing your orders to market makers, brokers earn small fees, while the market makers profit from buying low and selling at the price you’re willing to pay. While you’re not paying a direct commission, there are still exchange fees involved in each trade. Ultimately, your order is finalized at an exchange like NYSE or Nasdaq, ensuring that all parties—including brokers, market makers, and exchanges—benefit from the transaction, even when it’s commission-free for you.

Leave a Reply