🗓️ What Just Happened?

On June 13, 2025, Israel launched a surprise military operation against Iran, striking nuclear facilities and killing top Iranian officials. The move, known as Operation Rising Lion, came just days before a planned U.S.–Iran nuclear negotiation in Oman. This led many to believe Israel acted to disrupt the talks.

Targets included key sites like Natanz (a major nuclear enrichment hub) and missile development centers. Explosions lit up Tehran. Prime Minister Netanyahu confirmed the strikes, vowing continued action against Iran’s nuclear program.

🚀 Iran’s Response — Lots of Noise, Little Impact

Iran responded by sending around 100 drones toward Israel. But nearly all were intercepted by Israeli air defenses — with help from regional neighbors like Jordan and Saudi Arabia.

Despite aggressive rhetoric and calls this a “declaration of war,” Iran’s retaliation has so far been contained to drones and threats. Thankfully, no radiation leaks or mass civilian casualties have been reported. Talks, however, are now suspended.

🌍 Global Fallout and Market Reaction

World powers condemned the attack, while the U.S. walked a fine line: not involved, but reportedly aware of the plan in advance.

Markets didn’t take it well:

- Oil jumped 7–8% on supply fears

- Gold soared past $3,440 as a safe haven

- Stock futures dropped 1.5–2% overnight

- Flights rerouted across the Middle East as airspace closed

💡 Why I’m Seeing Green in a Sea of Red

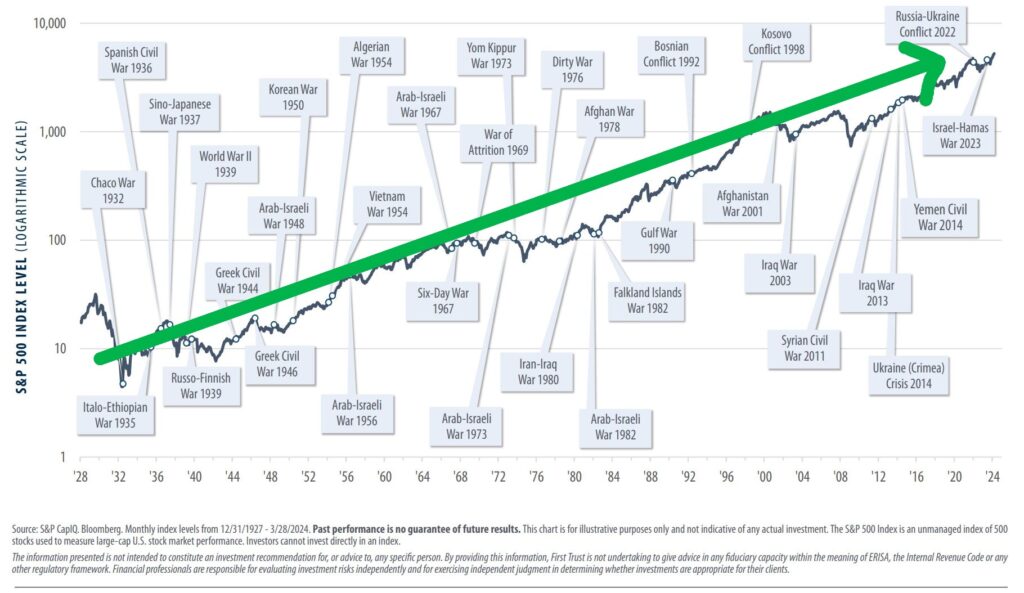

This isn’t the first time markets panicked over war headlines. Historically, they snap back quickly — because the fundamentals of strong businesses don’t change due to far-off geopolitical noise.

Companies like Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and NVIDIA (NVDA) aren’t tied to oil, missiles, or drone strikes. But their stock prices are being pulled down anyway — and that’s an opening for investors.

These are businesses with moats, cash flows, and long runways. When their prices fall for reasons unrelated to their actual performance, that’s a gift.

🧭 Final Word: Fear Creates Opportunity

Yes, the headlines are loud. But wars tend to be short-lived market shocks. Unless you believe this will spiral into something far bigger — and permanent — history says to stay the course.

I’m not buying oil stocks. I’m not buying gold. I’m buying high-quality companies while others panic.

Because the market always recovers — and the best returns go to those who stayed calm while others ran for the exits.

👉 Panic is temporary. Compounding is forever.

Leave a Reply