So far in our investing journey, we’ve learned how to identify great businesses, understand their strengths, and ensure we’re purchasing them at the right price.

But even the best companies can face unforeseen challenges. That’s where diversification becomes essential.

🧺 Why Diversification Matters

No matter how confident you are in a company, unexpected events can derail it. Even strong businesses can face:

- Industry disruptions

- Regulatory changes

- Product failures

- Management missteps

Think of diversification like a seatbelt. You don’t expect a crash every time you drive, but you still buckle up — just in case.

Diversification helps ensure that when one part of your portfolio stumbles, the whole thing doesn’t come crashing down.

✔️ What Is Diversification?

In simple terms:

Diversification means spreading your investments across different sectors and industries so that no single company or event can sink your entire portfolio.

You’re not eliminating risk — that’s impossible — but you’re managing it by making sure no one investment holds too much power.

🧭 How Many Sectors Are There?

The U.S. stock market (via the S&P 500) is divided into 11 major sectors. As of April 30, 2025, their approximate weightings in the S&P 500 are:

- Information Technology – 30.3%

- Financials – 14.5%

- Health Care – 10.8%

- Consumer Discretionary – 10.3%

- Communication Services – 9.3%

- Industrials – 8.5%

- Consumer Staples – 6.2%

- Energy – 3.2%

- Utilities – 2.6%

- Real Estate – 2.3%

- Materials – 2.0%

You don’t need exposure to all of them. In fact, depending on your investing style and comfort level, some sectors may not be worth your attention.

🚫 Sectors We Tend to Avoid (and Why)

Some industries are just harder to invest in for the long term. Here are a few we typically skip:

- Airlines ✈️

Cutthroat competition, low margins, high regulation, and sensitivity to oil prices. - Auto Manufacturers 🚗

Capital intensive, price wars, hard to predict winners — even in EVs. - Pure Pharmaceutical Companies 💊

Often rely on one or two key drugs, and face big risks when patents expire or clinical trials fail.

These sectors might produce the occasional winner, but for long-term investors, the risk-to-reward ratio is often unfavorable.

✅ What We Look for Instead

Rather than chasing uncertain opportunities, we focus on companies that offer:

- High returns on capital

- Durable competitive advantages

- Predictable, growing cash flows

- Scalable business models

These are the kinds of businesses that can quietly build wealth over time — even when markets get noisy.

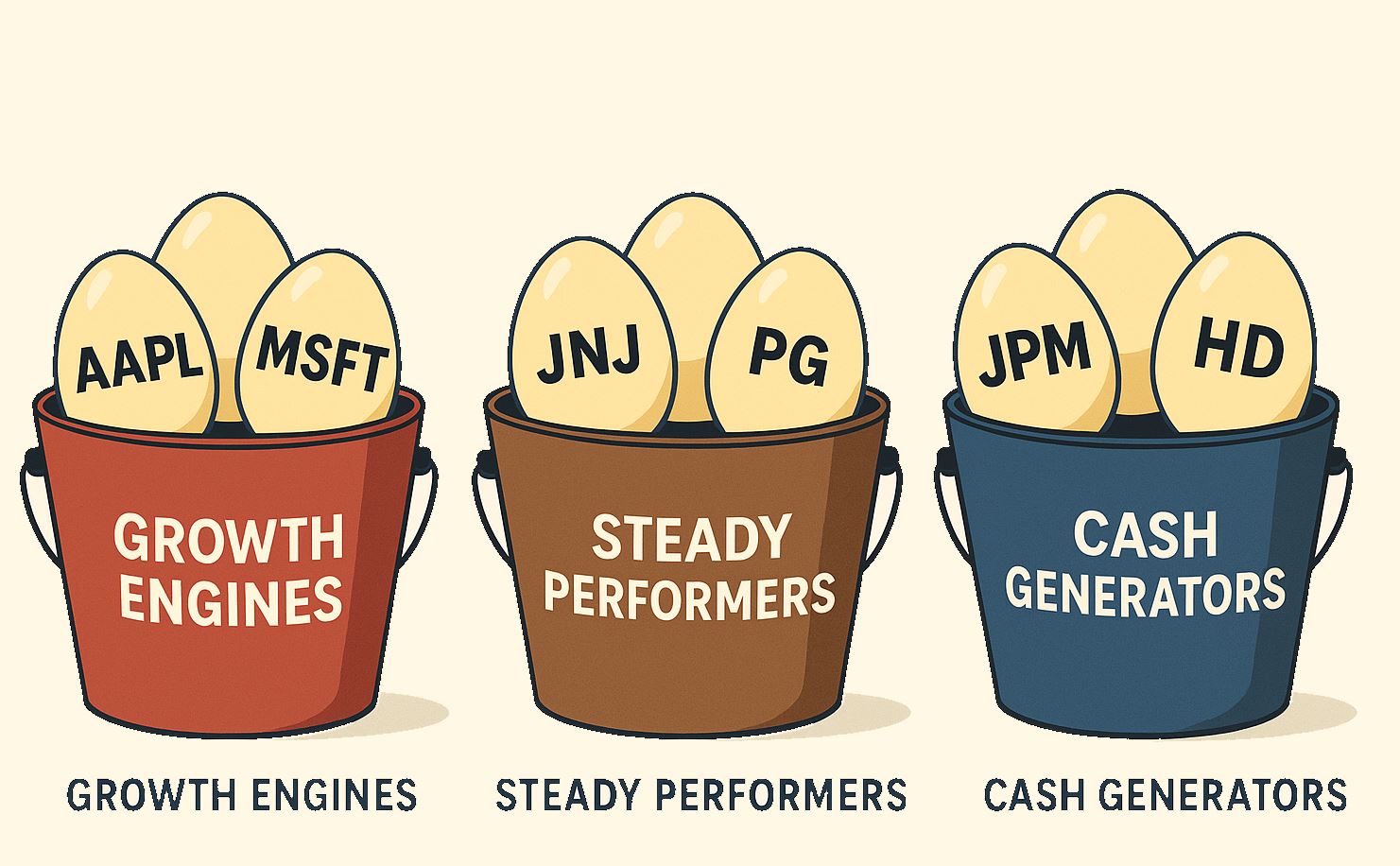

🧠 Think in Buckets

A simple way to build a diversified portfolio is to think in “buckets.” You don’t need dozens of stocks — just the right mix.

Here’s a basic framework:

Growth Engines 🚀

Innovative companies with strong growth potential, often in technology or digital platforms.

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Alphabet Inc. (GOOGL)

Steady Performers 🛡️

Reliable companies in sectors like consumer staples or healthcare that provide consistent performance.

- Johnson & Johnson (JNJ)

- Procter & Gamble Co. (PG)

- The Coca-Cola Company (KO)

Cash Generators 💰

Capital-efficient businesses in financials or industrials that reliably produce cash.

- JPMorgan Chase & Co. (JPM)

- Union Pacific Corporation (UNP)

- The Home Depot, Inc. (HD)

Note: The companies listed above are for illustrative purposes only and do not constitute investment recommendations.

Aim for 15–25 well-chosen companies across these buckets — that’s often more than enough for a resilient portfolio.

💬 Key Principles of Diversification

Here are a few timeless truths to keep in mind:

- Don’t concentrate on one sector — even if it’s hot right now.

- Watch for correlation traps — for example, owning several tech stocks that all move together.

- Stick to businesses you understand — even if that means skipping popular names.

Diversification isn’t about owning everything. It’s about owning a balanced mix of great companies, where no single one can ruin your results.

💡 Summary

- Diversification is your second line of defense, after buying with a margin of safety.

- Not every sector deserves your capital — focus on what fits your strategy.

- Build a portfolio that’s resilient, not reactive.

🔑 Final Takeaway

You don’t need to predict the future — just prepare for it.

Diversification is how you stay in the game, even when the unexpected happens. It keeps your portfolio standing tall, even when one or two pieces take a hit.

Leave a Reply