In normal times, when the stock market falls, we usually see money flow into “safe haven” assets like U.S. Treasury bonds and the U.S. dollar. That demand pushes Treasury prices up (yields down) and strengthens the dollar. But this time, something strange is happening:

Stocks are falling. Yields are rising. And the dollar is weakening.

This is an unusual mix of market signals, and it’s leaving many investors scratching their heads. So, what’s going on? And is this connected to the growing conversation around de-dollarization?

Let’s break it down.

🧩 What Normally Happens

When investors get scared—whether from economic worries, geopolitical tensions, or financial shocks—they usually seek out stability. That traditionally means:

- Selling stocks, which are risky,

- Buying U.S. Treasury bonds, pushing yields down,

- Buying U.S. dollars, strengthening the currency.

This behavior is called a “flight to safety.” It’s based on the belief that the U.S. government is the most trustworthy borrower in the world, and the dollar is the most reliable store of value.

🔀 What’s Happening Now (And Why It’s Strange)

Instead of a typical flight to safety, we’re seeing:

- Stocks falling due to fears of a slowing economy and sticky inflation.

- Bond yields rising—which means investors are demanding higher returns to hold U.S. debt.

- The dollar weakening, despite uncertainty, which is not typical during market stress.

This pattern suggests something deeper is at play. One explanation could be reduced demand for U.S. Treasuries from foreign investors, which is where the conversation around de-dollarization enters the picture.

🌍 What is De-Dollarization?

De-dollarization refers to the gradual global shift away from using the U.S. dollar as the dominant currency for trade, investment, and reserves. Countries like China, Russia, Brazil, and others have publicly stated their desire to reduce dependence on the dollar, especially in the wake of sanctions and rising geopolitical tensions.

One of the biggest motivations behind this trend is the growing “weaponization” of the U.S. dollar. Because the dollar is the world’s reserve currency, the U.S. has the power to use financial tools—like sanctions, asset freezes, and SWIFT restrictions—to pursue foreign policy goals without deploying troops. This power, sometimes called the “exorbitant privilege,” has been used more frequently since 9/11, and intensified after the 2022 Russian invasion of Ukraine.

Some headlines have claimed that China is “dumping” U.S. Treasuries as part of its de-dollarization effort. However, a closer look reveals that China’s holdings have been gradually declining for years, not due to panic or retaliation, but as part of a broader diversification strategy. Japan remains the largest foreign holder of U.S. Treasuries, which suggests that while de-dollarization is happening, it’s a slow and selective process—not a global abandonment of the dollar.

🌐 Who Benefits from a Declining Dollar?

The question isn’t just whether the dollar is losing dominance—it’s also who gains if it does.

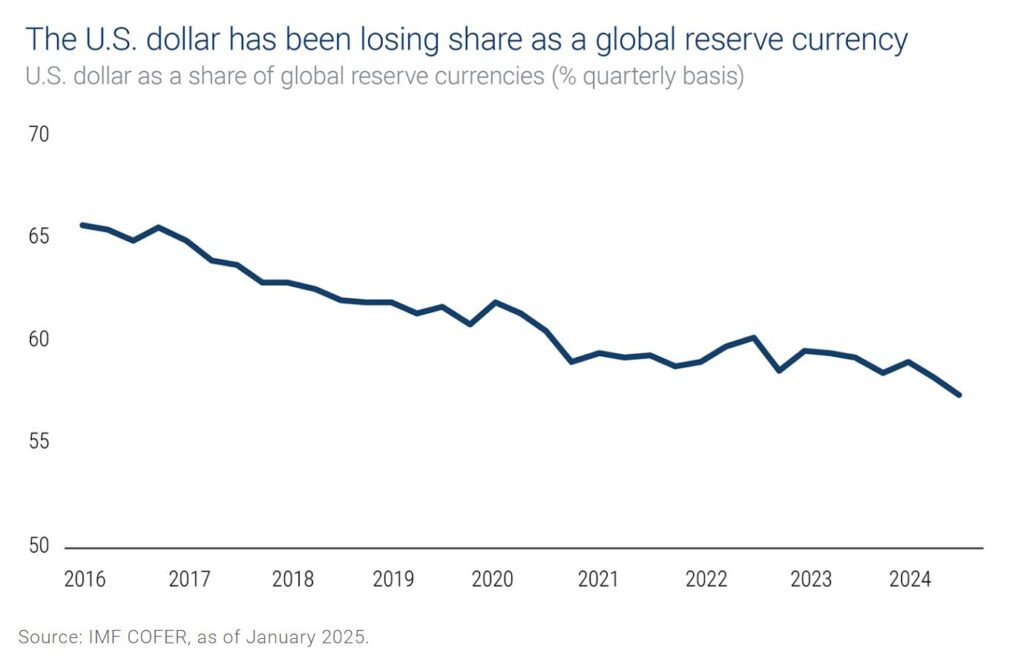

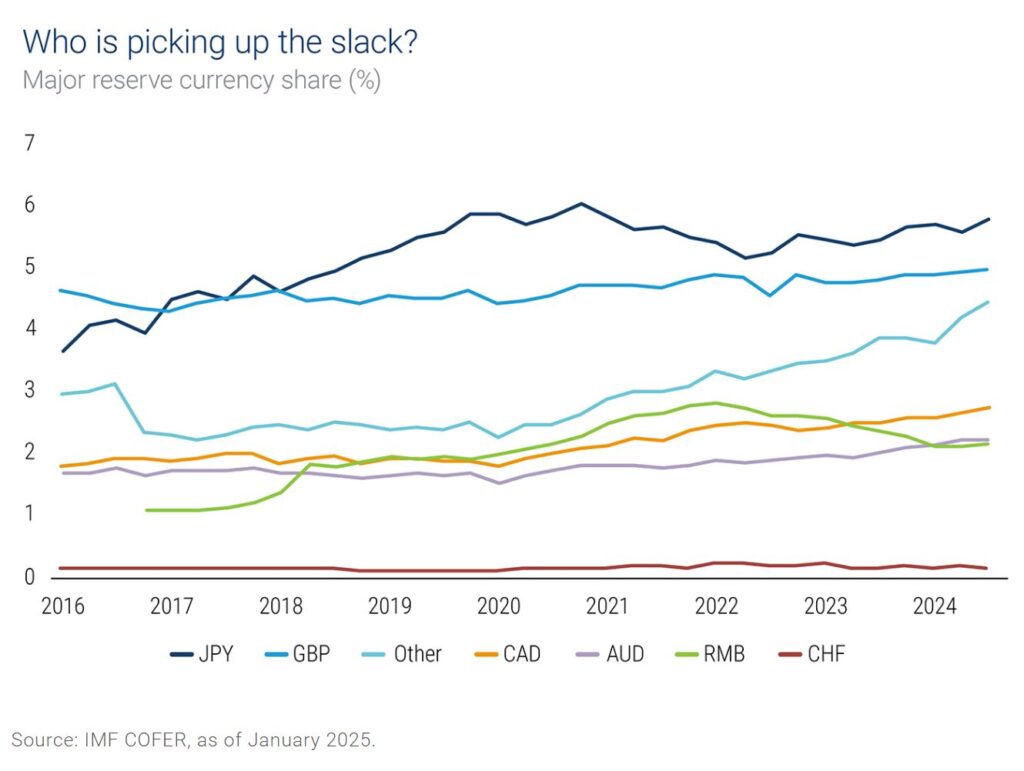

Since 2000, economists have predicted a gradual decline in the dollar’s share of global reserves. But instead of a single new reserve currency rising to take its place, a diverse group of currencies has been gaining ground. These include:

- Japanese yen

- British pound

- Australian dollar

- Canadian dollar

- Swiss franc

According to the IMF’s COFER data, these smaller but stable currencies have steadily grown their share, and this trend is likely to continue over the next decade.

Two other non-traditional currencies are also worth watching:

- The South Korean won, due to its strong economic ties, large economy (12th largest globally), and growing geopolitical role—including talks to join the AUKUS security alliance.

- The Indian rupee, as India becomes a larger global player, part of both the Quad (with the U.S., Japan, and Australia) and BRICS, with a neutral, non-aligned stance.

So while the U.S. dollar may lose some market share, it’s not being replaced by one currency, but by many—each picking up a small piece of the pie.

🧭 Final Thoughts

This isn’t business as usual. For decades, the world has relied on the U.S. dollar and Treasuries as the backbone of global finance. Now, we’re witnessing a shift—subtle but significant—as investors and governments explore alternatives.

That said, I still believe the U.S. dollar will remain the world’s reserve currency for the foreseeable future. No other currency system offers the same combination of liquidity, transparency, legal stability, and trust as the U.S. financial system.

More importantly, the most innovative, valuable, and globally competitive companies—like Apple, Microsoft, NVIDIA, and many others—are based in the United States. Global investors still want exposure to them, and that means they still need U.S. dollars.

Yes, de-dollarization is something other countries want. But so far, they haven’t found a strong enough alternative to dethrone the dollar. The U.S. has many challenges, but its financial leadership remains firmly in place for now.

Leave a Reply