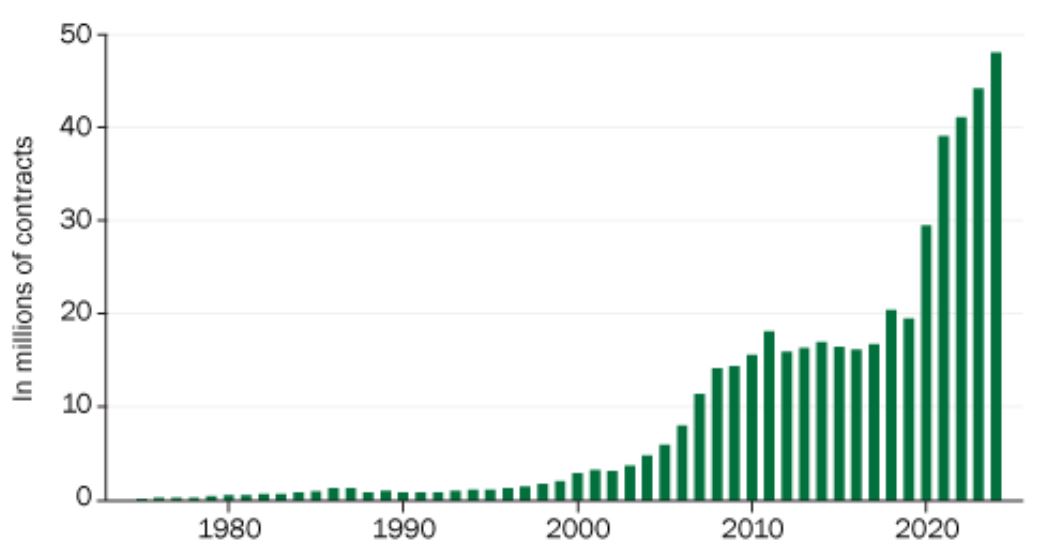

Today, More People Than Ever Trade Options

In recent years, options trading has exploded in popularity. With the rise of online trading platforms and access to financial markets becoming easier, millions of investors are trying their hand at trading options. But while options can be a powerful tool for generating income and managing risk, they can also lead to significant losses if not used correctly.

The Two Paths of Options Trading

- The Not-So-Safe Way

Many new traders approach options with a mindset of speculation, aiming for quick profits by gambling on short-term price movements. They often:- Buy out-of-the-money calls or puts, hoping for a large price swing.

- Take on excessive risk without fully understanding the contract terms or market conditions.

- Over-leverage their account, which can lead to massive losses if the trade goes against them.

💡 Reality Check: Buying options may seem exciting, but studies show that most options buyers lose money over the long term. Why? Because time decay works against the buyer, and predicting short-term market moves is extremely difficult.

- The Safe Way: Selling Options with a Plan

Instead of speculating, the safer approach is to sell options on strong companies you wouldn’t mind owning. This way, you use options to generate consistent income rather than chasing high-risk trades.

Here’s why selling options (the wheel strategy) is a better path:

- Time Decay Works in Your Favor: As an option seller, you benefit from the natural decline in the option’s value as expiration approaches.

- You’re in Control: You set the terms of the trade—choosing the strike price, expiration date, and premium that align with your goals.

- Risk Management: By selling puts only on stocks you want to own, you turn a potential assignment into a long-term investment opportunity.

- Market-Beating Returns: When done consistently, selling options can generate returns that exceed the average stock market performance.

Why More People Are Trading Options Today

- Increased Awareness

Social media, online communities, and educational resources have made it easier to learn about options trading. People are drawn to the idea of making money from the stock market without having to rely solely on buying and holding stocks. - Easy Access

Platforms like Robinhood, Webull, and others have made options trading accessible to anyone with a smartphone. Lower fees and easy-to-use interfaces have attracted a new wave of retail traders. - Promise of High Returns

Many traders are attracted to the idea of turning small amounts of money into big gains by trading options. Stories of “overnight successes” encourage speculative behavior, even though the risks are often overlooked.

The Safe Way Explained: Start with Strong Companies

If you’re serious about trading options safely, the foundation of your strategy should always be strong companies. These are businesses with:

- Consistent revenue growth

- Healthy balance sheets

- Competitive advantages

- Steady cash flow

💡 Why? These companies tend to recover from market downturns, making them reliable investments even if you’re assigned shares after selling puts.

A Chart to Keep You Grounded

When thinking about options trading, visualize this chart:

| Options Trading Style | Outcome |

|---|---|

| Speculative (Buying Options) | High Risk, Unpredictable Returns, Often Losses |

| Conservative (Selling Options) | Lower Risk, Steady Income, Long-Term Gains |

Key Insight:

Options trading can either be a rollercoaster ride of speculation or a methodical, consistent strategy for wealth building. The choice is yours.

The Numbers Don’t Lie

When you choose to sell options with a plan, you’re not gambling—you’re creating a system designed to win over time. Let’s revisit the key reason why this strategy works:

- 2–3% Per Month = 24–36% Annual Return

- Compare this to the average annual S&P 500 return of 8–10%, and you’ll see why selling options is such a powerful tool.

If your goal is to build wealth while minimizing risk, focus on steady, predictable returns rather than chasing unrealistic gains.

Final Thoughts: There’s a Right Way and a Wrong Way

While the allure of options trading may tempt you to take unnecessary risks, remember that slow and steady wins the race. By selling options on fundamentally strong companies and following the wheel strategy, you’re creating a safe, consistent income stream that can beat the market over time.

💡 Take Action: Start with a clear plan, focus on long-term goals, and always prioritize safety over speculation. The market rewards disciplined investors who think strategically—and with this approach, you can join them.

Leave a Reply